India’s defence outlay is likely to grow at ~12 per cent to ~USD 147 billion over FY2025-29E

By Vikas Gupta

Defence News of India, 14th Nov 23

Amidst rising defence spending by East European and West Asian countries, a new report from Axis Capital Research focuses on India’s defence production and indigenization program. It predicts that the compounded annual growth rate (CAGR) of India’s defence outlay is likely to grow at ~12 per cent to ~USD 147 billion over FY2025-29E.

The Axis report draws on data from India’s annual budget, ministry of defence (MoD) media releases, the World Bank and international bodies such as the Stockholm International Peace Research Institute (SIPRI)

The government’s ongoing policy push for import substitution and exports is a big propellent, driving the 15 per cent CAGR in India’s defence production turnover.

“Evolving geopolitical equations will strongly influence growth in defence spending and trade relationships,” stated a media release from Axis Capital.

The report maps the capabilities of key players in defence sector. Sixteen defence public sector undertakings, or DPSUs, of which seven are listed, account for more than 70 per cent of India’s defence production.

A consolidated Profit & Loss for the 13 stocks in the Nifty Defence Index has seen an 19 per cent CAGR in revenue to Rs 700 bn and ~25 per cent profit-after-tax (PAT) CAGR to Rs 116 bn over FY21-23.

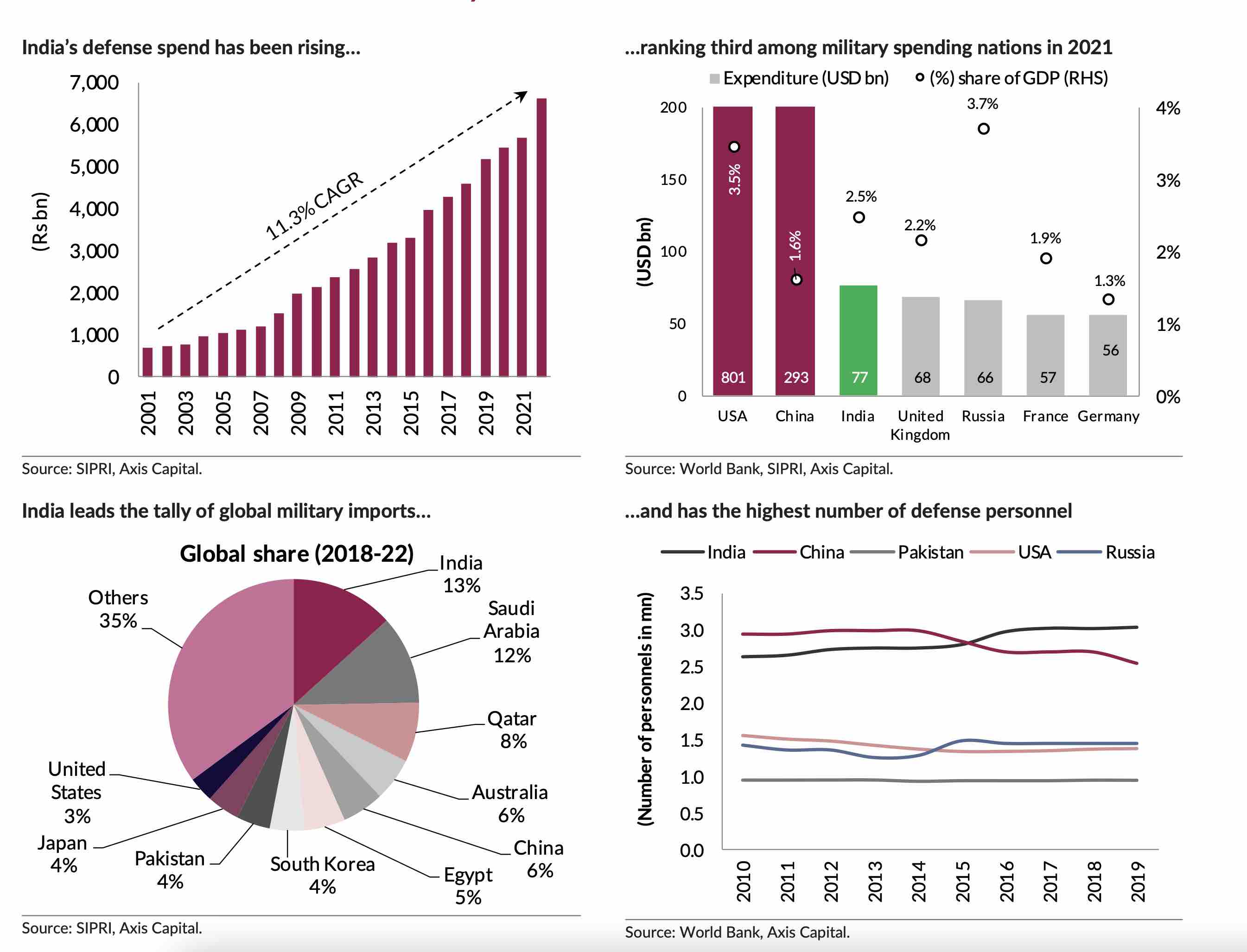

Sumit Kishore, lead analyst of Axis Capital Research says geopolitical equations and GDP are key growth drivers for military spending. Global defence spending was at a median of ~2.3 per cent of global GDP in the past 25 years.

Asia’s rapid economic growth, territorial disputes, and political tensions have increased its share in global defence spending from 24 per cent to 34 per cent over the past decade.

According to SIPRI, India’s annual military spending of USD 77 bn ranked a distant third in 2021, after the US (USD 801 bn) and China (USD 293 bn). The shift from a unipolar to a multipolar world is visible from the shift in the US-China defence spending ratio.

China defense spending ratio shifted from 6 : 1 in 2011 to 2.7 : 1 in 2021.

Report Highlights Defense trade in a multipolar world.

The global arms trade was USD 127 billion in 2021. Six countries accounted for 80 per cent of global defence exports over 2018-22. These include the US (40 per cent), Russia (16 per cent), France (11 per cent), China (5 per cent), Germany (4 per cent), and Italy (4 per cent).

Over this period, Asia and Oceania accounted for over 70 per cent of defence imports, led by India (13 per cent) and Saudi Arabia (12 per cent).

In a multipolar world, India is shifting imports away from Russia to France and the US. Russia is China’s main import partner while China is Pakistan’s. Geopolitics, more than products, determines EXIM deals.

Channelizing India’s growth dividend.

Over the past decade, India’s gross budgeted defence spend saw ~9 per cent CAGR, to Rs 5.93 trillion in FY24 – at 1.95% of GDP, the lowest in a decade, down 31 bps from FY14.

Only 27 per cent of the FY24 defence spend was earmarked for capital procurement.

Meanwhile, India has the world’s largest number of defence personnel (3 million plus).

“Pensions/pay & allowances and capital outlay have seen 10.1 per cent and 7.5 per cent CAGR, respectively, over the past decade. Technology-driven optimization of revenue expenditure and innovative schemes like ‘Agnipath’ to reduce pension outgo are imperative to realize the full potential of India’s growth dividend,” says the Axis Capital release.

Indigenization and export push.

The government has prioritized local procurement and announced time-bound import embargoes for a large list of products. It has offered R&D support, liberalized FDI norms, has set up two defence manufacturing corridors, and is also fast-tracking export authorizations.

A progressive increase in the share of indigenous procurement for defence is one of the key levers for the expected increase in defence production growth rate – from 6.6 per cent CAGR over FY17-23 to 15 per cent CAGR over FY23-29E.

Defence exports, led by private companies, have grown to Rs 159 billion in FY23 (FY26 target is Rs 350 billion) from just Rs 15 billion in FY17. The share of exports in defence production turnover has increased from 2 per cent in FY17 to 15 per cent in FY23.