SOURCE: Ajai Shukla / Business Standard

With the Defence Acquisition Policy of 2020 (DAP 2020) introducing “leasing” as a new option for equipment acquisition, senior Ministry of Defence (MoD) officers discussed the pros and cons with defence industry executives at a webinar organized by Ficci on Tuesday.

DAP 2020 defines leasing as a “means to possess and operate [a military] asset without owning the asset” and says it provides a useful way “to substitute huge initial capital outlays with periodical rental payments.”

The only one of the three services that has significant experience of leasing defence equipment is the navy, which has successively leased two nuclear-powered submarines from Moscow. The second of them, which was leased in 2012 for a ten-year period, is still in the Indian Navy fleet.

Opinion is divided on whether leasing provides a viable acquisition option for defence equipment. Former secretary (defence finance), Gargi Kaul, expressed strong reservations about the way the new leasing policy “tied the hands” of the defence ministry bureaucrats and opined that it could, at best, be a government-to-government arrangement.

Kaul also stated that competitive procurement in the leasing category would be difficult since there would be, in most cases, just one vendor eligible. She pointed out that there is not a single Indian company that is in the business of leasing military equipment.

In contrast, Vice Chief of Naval Staff, Vice Admiral G Ashok Kumar termed leasing as “a path breaking change that provides an opportunity to mitigate short-term capability gaps, considering the long gestation period of shipbuilding contracts.”

He said the navy would primarily lease “operational support assets and auxiliary vessels to enhance our operational capabilities and yet avoid huge investments in manning and maintaining them.”

The navy will lease “multi-role platforms, where specific capabilities can be slapped on,” says Kumar, so that there is an end to “using high-end platforms for low-end tasks.”

Towards this end, the navy will lease vessels for coastal security patrols, minesweeping, seabed mapping, and auxiliary vessels such as tankers, barges and tugs. “We could also look at operational enablers such as utility helicopters, unmanned solution and high-speed aerial and surface targets for operational preparedness of the navy,” said Kumar.

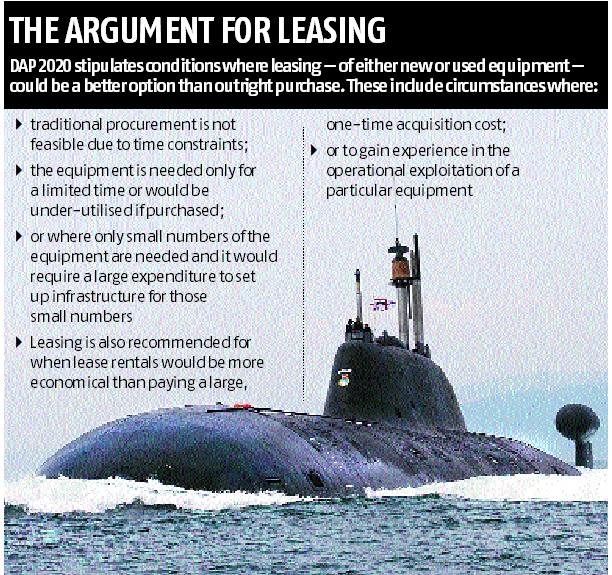

DAP 2020 stipulates conditions where leasing – of either new or used equipment – could be a better option than outright purchase. These include circumstances where traditional procurement is not feasible due to time constraints; where the equipment is needed only for a limited time or would be under-utilised if purchased; or where only small numbers of the equipment are needed and it would require a large expenditure to set up infrastructure for those small numbers.

Leasing is also recommended for when lease rentals would be more economical than paying a large, one-time acquisition cost; or to gain experience in the operational exploitation of a particular equipment. ?

Kaul said there are not many examples of successful leasing of defence platforms. She said it would be difficult to make the case to the department of defence finance that, for a particular platform, leasing would be more economical than an outright purchase.

Kumar, however, pointed out that leasing has been adopted by many armed forces around the world. He said the US had leased ships to augment military capability in World War II, the Korean War (1950-53) as well as the Vietnam War in the 1970s. The US Navy has a long history of leasing several categories of “off-the-shelf auxiliary support equipment,” he said.

Similarly, the Royal Air Force in the UK has leased aircraft, including P-8 maritime reconnaissance aircraft; the Italian Air Force has leased 34 F-16 fighters from the US Air Force to ease pilot transition from the F-104 to the Eurofighter, and the Philippines have leased the TC-90 trainer from Japan. Norway and Denmark are using leased aircraft for maritime patrol and oil pollution detection at sea.

DAP 2020 permits leasing in two categories: Lease (Indian), the preferred category, where the lessor is an Indian entity and owns the asset; and Lease (Global), which refers to lease of equipment from foreign or Indian Lessors.